Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Blackstone’s ethical standing is complex and debated. Opinions vary based on its business practices and societal impact.

Blackstone, a prominent private equity firm, plays a significant role in global finance. Its investments span multiple sectors, including real estate, healthcare, and technology. Critics argue Blackstone prioritizes profit over social responsibility, leading to ethical concerns. Supporters highlight its contributions to economic growth and job creation.

Transparency and corporate governance are key factors in assessing its ethics. Public perception varies, influenced by media coverage and individual experiences. Analyzing Blackstone’s ethics requires a nuanced understanding of its operations and impact. Balancing profit motives with social responsibility remains a challenge for the firm.

Credit: www.slideteam.net

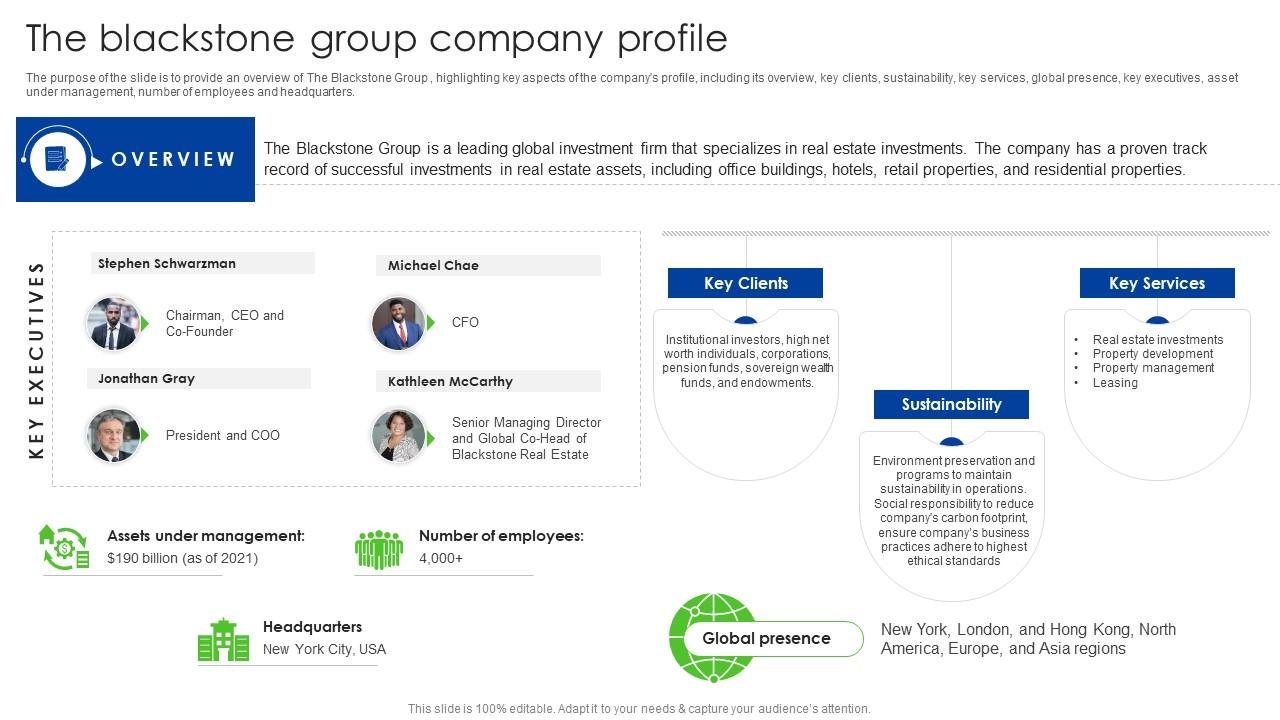

Blackstone is a global investment firm. It focuses on private equity, real estate, and credit. The company manages assets for many clients. This includes pension funds and individual investors. Understanding Blackstone’s business model helps to evaluate its ethical standing.

Blackstone employs diverse investment strategies. These include leveraged buyouts, growth capital, and distressed asset acquisitions. The firm aims to increase value in acquired companies. It often restructures operations and finances.

Blackstone also invests in real estate. It acquires commercial and residential properties. The firm enhances these assets to boost returns. Another key strategy is credit investments. This involves lending to companies and buying debt securities.

| Strategy | Description |

|---|---|

| Leveraged Buyouts | Buying companies using borrowed money |

| Growth Capital | Investing in expanding companies |

| Distressed Assets | Buying undervalued or troubled assets |

| Real Estate | Investing in property assets |

| Credit | Lending and buying debt |

Blackstone targets several key sectors. These include healthcare, technology, and energy. In healthcare, Blackstone invests in hospitals and medical devices. It aims to improve healthcare services and products.

In the technology sector, the firm focuses on software and data companies. Blackstone helps them grow and innovate. Energy investments include renewable energy projects. Blackstone supports sustainable and clean energy initiatives.

These key sectors reflect Blackstone’s diverse investment approach. They also show its focus on long-term growth and sustainability.

Corporate governance is a crucial element in evaluating the ethical standards of any company, including Blackstone. Strong corporate governance ensures that a company operates transparently and responsibly. This helps in maintaining trust with stakeholders. This section will explore Blackstone’s corporate governance practices under three main areas: Leadership and Board Structure, Transparency, and Accountability.

Blackstone’s leadership and board structure play a vital role in its corporate governance. The company has a diverse board comprising experienced professionals. This ensures a balance of power and a variety of perspectives.

Here is a quick overview of Blackstone’s leadership:

| Position | Person | Experience |

|---|---|---|

| CEO | Stephen Schwarzman | Over 30 years |

| CFO | Michael Chae | 20 years |

Blackstone emphasizes transparency and accountability in its operations. The company regularly publishes detailed financial reports. This helps stakeholders understand the company’s performance and strategies.

Key practices include:

These practices ensure that Blackstone remains accountable to its shareholders and the public.

Understanding Blackstone’s environmental impact is crucial for evaluating its ethical stance. This section explores the firm’s sustainability efforts and climate change policies.

Blackstone has initiated several sustainability efforts to minimize its environmental footprint. These initiatives aim to reduce waste, conserve resources, and promote eco-friendly practices.

The company invests in green technologies to improve energy efficiency. Such investments include LED lighting, smart thermostats, and solar panels.

Blackstone also encourages its portfolio companies to adopt sustainable practices. This drive is part of its broader commitment to environmental responsibility.

Blackstone has established clear climate change policies to address global warming. These policies focus on reducing greenhouse gas emissions and promoting renewable energy.

| Policy | Action |

|---|---|

| Emission Reduction | Targets set for portfolio companies |

| Renewable Energy | Investments in wind and solar projects |

| Carbon Offsetting | Support for reforestation initiatives |

These policies ensure that Blackstone remains accountable for its environmental impact. The firm regularly reviews and updates these policies to align with global standards.

Blackstone’s climate change policies demonstrate its commitment to a greener planet. By investing in renewable energy, the firm aims to reduce reliance on fossil fuels.

Through these efforts, Blackstone seeks to play a key role in mitigating climate change.

Credit: greenstarsproject.org

Social responsibility is a crucial aspect of evaluating a company’s ethics. Blackstone, a global investment firm, has various initiatives under its belt. These initiatives focus on improving community welfare and labor conditions.

Blackstone invests in local communities through multiple programs. These programs aim to improve education, healthcare, and housing.

They also encourage employees to volunteer. This enhances their impact on community welfare.

Labor practices are another area where Blackstone shows its ethical stance. They focus on fair wages and safe working conditions.

| Aspect | Details |

|---|---|

| Fair Wages | Ensures all employees receive a living wage. |

| Safe Conditions | Implements strict safety protocols in workplaces. |

Employee training programs also play a big role. These programs aim to improve skills and offer career advancement.

The question of whether Blackstone operates ethically has many layers. One important aspect is their financial ethics. This includes their tax practices, investor relations, and overall financial transparency. Let’s delve into these areas to understand better.

Tax practices are crucial in evaluating financial ethics. Blackstone’s tax strategies often come under scrutiny. They use complex structures to minimize tax liabilities. This is legal but raises ethical questions. Critics argue it deprives governments of revenue. Supporters say it maximizes investor returns.

| Aspect | Details |

|---|---|

| Tax Minimization | Uses legal structures to reduce taxes |

| Criticism | Reduces government revenue |

| Support | Increases investor returns |

Blackstone’s investor relations are a key part of their financial ethics. They prioritize transparency and communication. They hold regular meetings and updates. They disclose important information promptly.

Investors appreciate this approach. It builds trust and confidence. Yet, some say it’s not enough. They want more detailed financial reports. They demand clearer explanations of complex deals.

The ethical standing of Blackstone has been a hot topic. This investment giant has faced numerous controversies. Criticisms have ranged from business practices to social impacts. Let’s dive into some of the key issues.

Blackstone has been involved in many notable scandals. One major scandal was their investment in rental properties. Critics accused them of raising rents too high. This affected many low-income families.

Another scandal involved tax avoidance. Reports suggested Blackstone used loopholes to pay less tax. This angered many taxpayers and watchdog groups.

| Scandal | Impact |

|---|---|

| Rental Property Investments | High rents, affected low-income families |

| Tax Avoidance | Less tax paid, public outrage |

The public’s perception of Blackstone varies. Many see them as a powerful investment firm. Some admire their financial success. Others see them as greedy and unethical.

Surveys show mixed feelings about Blackstone. Some think they help the economy. Others believe they hurt communities. This divided opinion shows the complexity of their impact.

Credit: www.amazon.com

Blackstone is controversial due to its involvement in aggressive real estate practices and investments in fossil fuels. Critics argue these actions harm communities and the environment.

The Blackstone Code of Ethics outlines the company’s commitment to integrity, compliance, and ethical conduct in all business activities.

No, Blackstone is not a Chinese company. It is an American multinational private equity firm based in New York City.

Yes, Blackstone incorporates ESG principles in its investment process. The company focuses on sustainability and responsible investing.

Blackstone’s ethical standing remains a complex issue. The company’s practices raise both praise and concerns. Ethical evaluations depend on individual values and perspectives. Conduct thorough research and consider diverse viewpoints. Make informed decisions based on the most recent information available.

Ethical considerations are crucial in shaping our economic landscape.